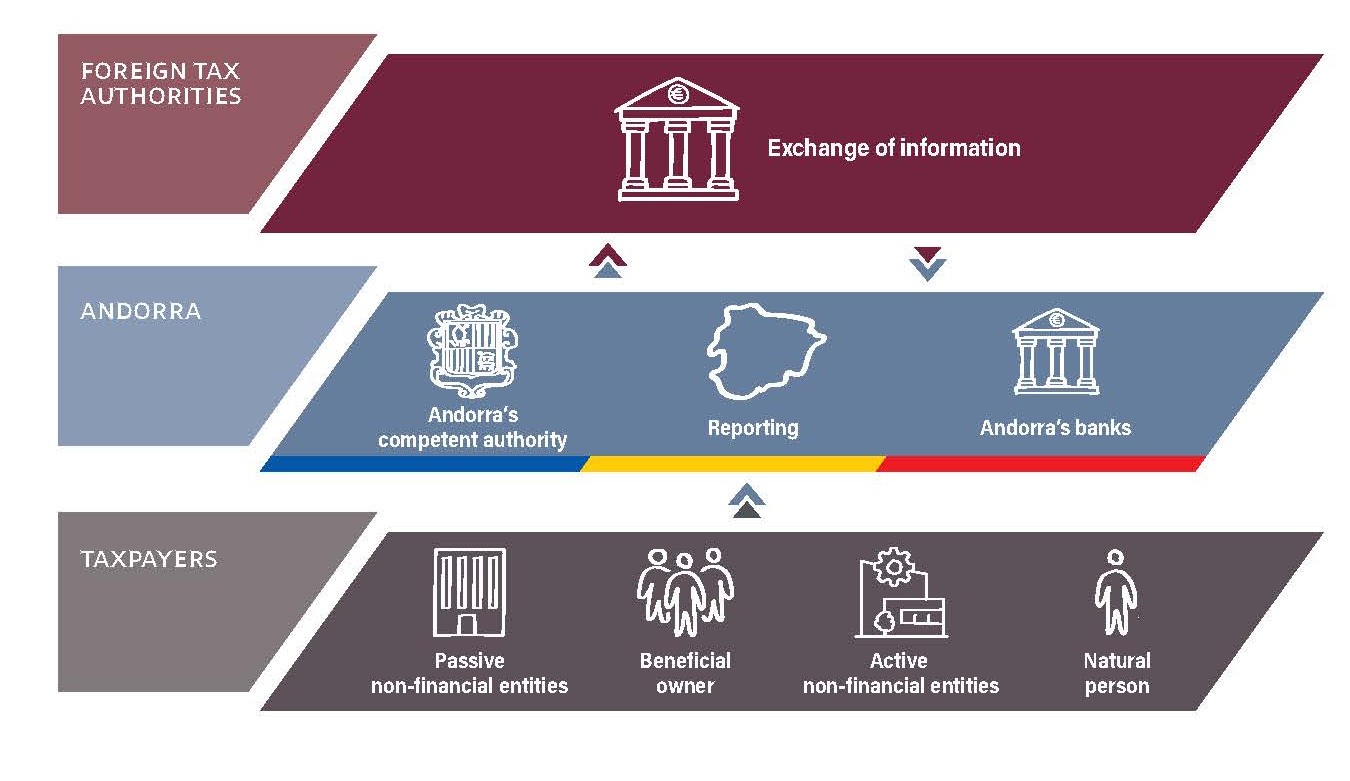

In 2014, and with the aim of fighting tax evasion and promote tax compliance, the OECD approved the Common Reporting Standard (CRS), a global standard for the automatic exchange of information in tax matters between jurisdictions (AEOI). This standard lays down how the competent authorities of the countries that have signed up to the CRS automatically exchange information on financial accounts every year.

In 2014, Andorra committed to implementing the CRS, and in 2016 it signed an AEOI agreement with the EU that incorporates the CRS standard.

At a national level, Law 19/2016 was passed to regulate the legal framework required to fulfil the AEOI commitment.

In 2023, the Automatic Exchange of Information (AEOI) team at the Global Forum (OECD) began its second round of peer reviews. As a result, in November 2023, the peer review team carried out the corresponding on-site visit to assess the effectiveness and understand the organisational and technical structure of both the authorities responsible for this exchange framework and the financial sector.