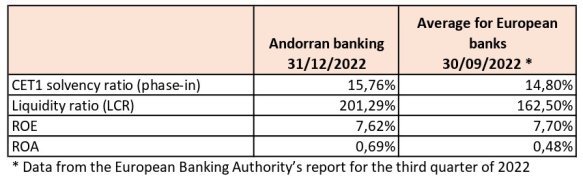

- The Andorran banking business model is sustainable over time, profitable with an ROE of 7.62% and geographically diversified.

- Banks enjoy a sound and well-managed balance sheet with a solvency ratio (CET1 – phase-in) of 15.76% and a liquidity ratio (LCR) of 201.29%, which is higher than the requirements set by the regulator and the average for European banks.

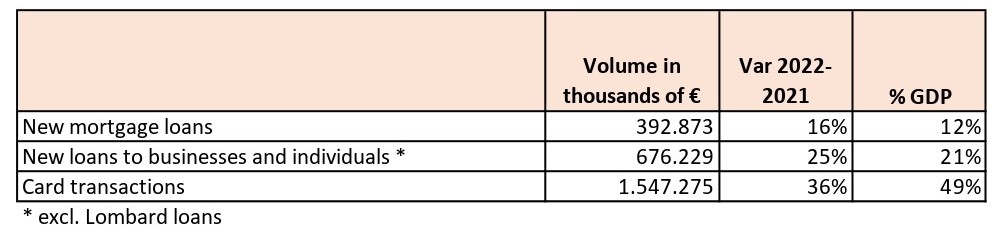

- The banking sector supports the country’s economic growth with new financing to the tune of €1.06bn euros (33.4% of GDP), and maintains a healthy balance sheet with a low default rate of 3.28%.

Andorra’s three banking institutions closed the year 2022 with an aggregate result of €113m. In a year marked by corporate transactions involving MoraBanc and Crèdit Andorrà, ECB interest rate hikes and strong inflation, the banking industry recorded a 16% growth in profits and a 3.3% rise in the volume of customer funds under management, reaching €63.69bn.

The banks’ business model demonstrates its resilience and sustainability. Together, Andorra’s three banks have achieved a return on equity (ROE) of 7.62%, in line with the average return of European institutions (EBA data for the third quarter of 2022) and up 158 basis points from 6.04% in 2021. The banking sector’s return on assets, as measured by ROA, stands at 0.69%, up from 0.60% in 2021 and above the European average. In 2022, the rise in interest rates made traditional lending more profitable and boosted profits. However, corporate transactions, continuing adaptation to international banking regulations and technological investments continued to put pressure on the banks’ results. The banking sector’s performance is key to instil confidence in the markets and bolster the country’s economic growth.

The strength and diversification of Andorra’s banking sector

Andorra’s banking sector remains robust and enjoys strong capitalisation with a CET1 (phase-in) solvency ratio of 15.76% as at 31 December 2022 (17% as at 31 December 2021). This is higher than the average for European banks, which stood at 14.8% according to EBA data for the third quarter of 2022. This ratio has been affected by the corporate transactions that have taken place in the industry. The M&As completed at both national and international level have allowed the financial institutions to generate growth both within and beyond Andorra’s borders, thus offering a more efficient, more robust and more responsive system for clients.

The liquidity ratio (LCR) was 201%, which is much higher than the minimum of 100% set by European regulators and above the average for European banks, which stood at 162% at the end of the third quarter of 2022. Despite the increase in Euribor, the rate of default continued its downward trend to 3.3% at the close of 2022 (down from 3.7% in 2021 and 5.32% in 2019).

These figures are a preview of the official closing data as at 31 December 2022, which have yet to be reviewed by auditors and approved by the Board of each institution.

Andorran banks drive the country’s economic growth

The banking sector supported the growth of the Andorran economy in 2022 with a local banking model that is closer to its clients. In a high inflation environment, the sector stepped up its efforts to support the projects of individuals, companies and institutions. While the total amount of credit investment remained stable at around €5bn, 702 new mortgages were granted to households for a total of €375m (+16% compared to 2021), which accounts for 12% of GDP. New loans to businesses and individuals amounted to €676m, up 25% from 2021, and accounted for 21% of national GDP. Also, the banking sector drove consumer spending through the various means of payment available, with a 36% increase in the volume of credit and debit card transactions at €1.54bn, accounting for 49% of GDP.

The general manager of Andorran Banking, Esther Puigcercós, highlighted that:

- “Andorran banks are profitable banks that support the growth of the economy, with €1bn of new financing transactions in 2022 alone. New financing for businesses and households accounted for 33% of GDP. Despite the inflationary tensions and the rise in interest rates, our financial institutions have shown great resilience and flexibility, increasing both their earnings and profitability.

- Andorran institutions enjoy a sound capital position with liquidity ratios above the average for European banks. The universal banking business model adopted by the Andorran banking sector, which combines banking for individuals, businesses and private banking, provides diversification in risk management, making it that much more resilient”.